Happy Monday TTU!

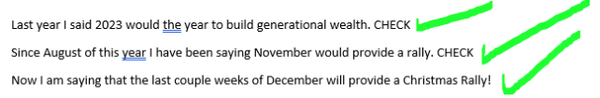

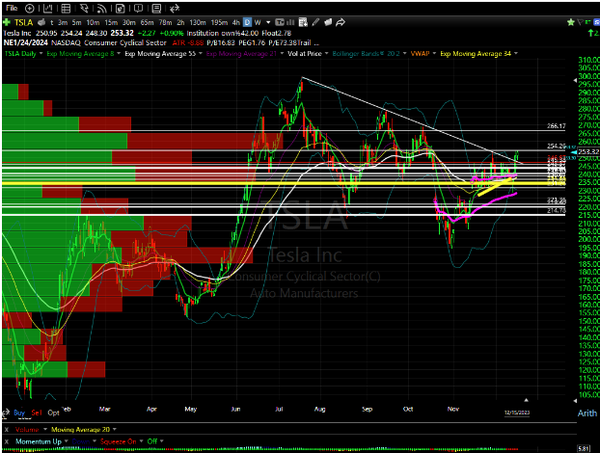

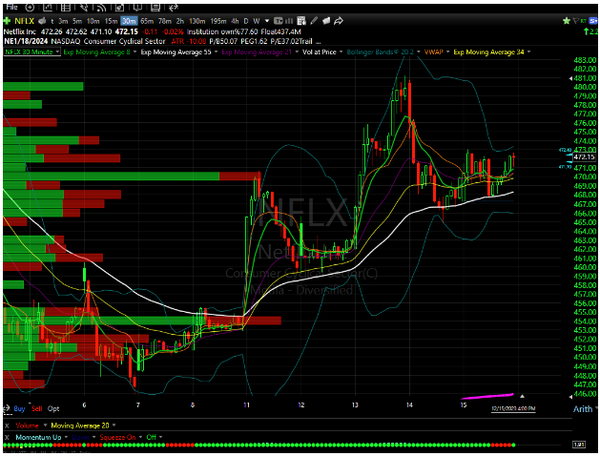

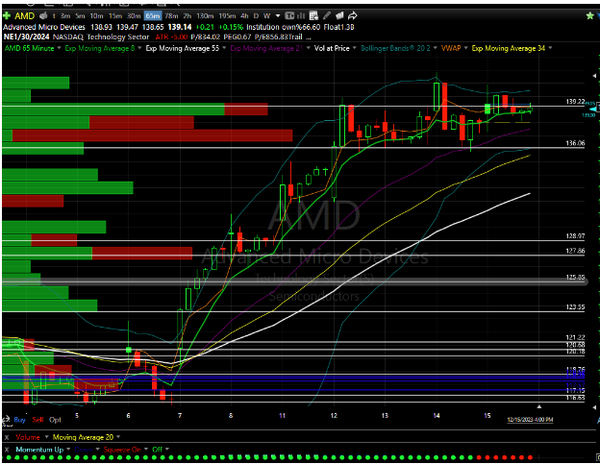

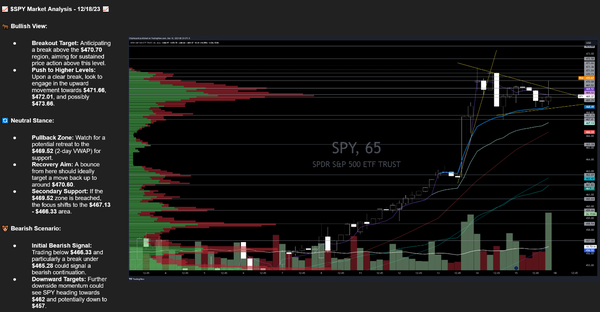

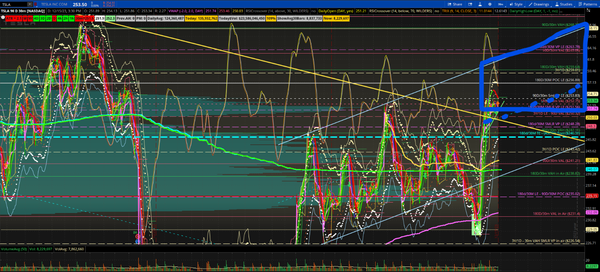

| Good Morning TTU Hello boys and girls! It is Santa clause and I have brought you a RALLY! From last weeks watch list –  I don’t think the rally is done but I do think it is time to start selling some of my longer term holdings and invest elsewhere. I stated this last week, but I wanted to reiterate. I started distributing INTC. I am taking this off because my target was reached. However, I am keeping a small piece on with a trail stop because I still believe we could go higher. The overall profit on the stock alone was 50+% in less than a year. Some of the options gave me 3-4X. I believe 50ish is fair value for INTC for what we know RIGHT NOW. They have other things that COULD happen that would increase their value. I also am distributing VNO. I am getting rid of ALL these positions. I still believe we could get another 10% higher, but I want the cash to be able to invest in things with a larger upside. One of the hardest things I did was sell some COST. It is one of my favorite companies in the world, but I stuck to the plan. I was also am distributing TMUS last week. One thing to always remember is you must pay taxes on capital gains. If you live in the USA, then holding for over a year allows you to fall into a lower tax bracket. (if you are trading in a vehicle that is taxable) Now that Powell has come out and shown that the FED is thinking of 3 rate cuts next year, the market is enjoying the Santa Clause rally. I do believe within the next couple of months we will hit a bump in the road. However, I think we are in the clear for this week. (barring some crazy news) With that understanding I am going to TRY and play some shorter time framed options! I normally focus on stocks, but I wanted to see if I can use options this week. Below you can see the changes for 2024 and 2025  Our absorption plan worked perfectly on SMCI and we reached the 300 goal. I will be playing this over under. If we get above this next is 315 then gap close.  One chart ive been in for a few weeks is AMZN I am still holding multiple positions on this. We got in first on 12-4 on the 195M squeeze then again on 12-11 and 12-12, then again on the pull back on 12-14. I have scalped out a hefty profit already but the goal is to make what I have left over eclipse that profit. There are a lot of people above us as you can see from the picture below. This just means that I will sell into resistance and then buy back after we get over the resistance and it becomes support.  Another one that I really like is TSLA – There are lots of negative stories coming out towards Elon Musk. Joe Biden has given the green light to go after Elon because he bought twitter and exposed the corruption. Just be aware of this if you are longing TSLA. TA wise – We have broken out of a downtrend after a failed breakdown.  NFLX is an inside day as well as a nice 30 minute chart – I’ll be playing this on a pull back OR a breakout.  AAPL has a nice 30 as well and is just under 200. It is also an ICBD and I’ll play this one for sure  AMD 65M TTM squeeze – Just realize on the daily we are riding the upper BB  GOOGL is an ICBW that I am playing for sure as well. SPY from JJ:  TSLA from TomTom: Previous ICB Weekly had engulfed the previous week’s pattern by crossing above 246.31 and hitting T1 (252.75) with last week’s high. (T2 257.18, T3 268.94). I am looking for this continuation to fill in and attack the upper trendline of my channel. I have updated the upward channel based on the latest consolidation that we broke out from while ignoring the crap news event. The blue trapezoidal area is where I am awaiting patterns for failure or continuation to touch the upper trendline between ~260-270. I need to see this stay above the 50% portion of the Channel (blue dashes) for continued confidence in riding the move up. Lastly, I need to see a true H/H towards the top of the channel trendline to eliminate the double top rejection. I am tracking another resistance trendline on the larger timeframe but we need to get past 270 and break out of this channel or we get into Jan before ER increases the chance that this will be a concern. On any retracement, I want to see us stay above the 247.11 to 246.31 level for support to attach the next Volume levels.  Economic News Schedule  Earnings This Week  |