Happy Monday TTU!

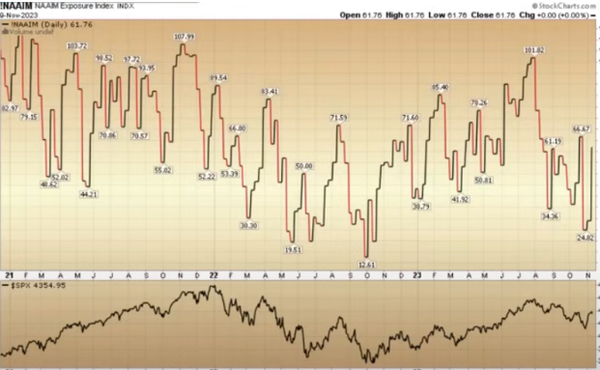

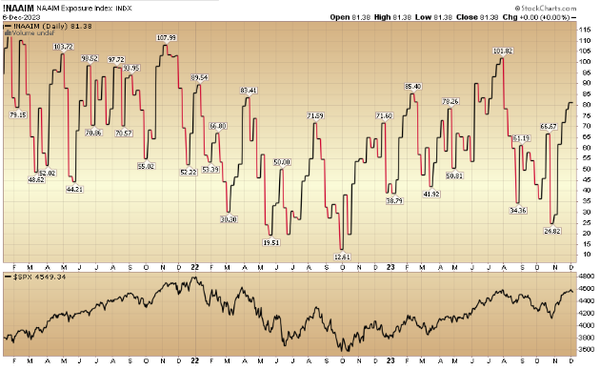

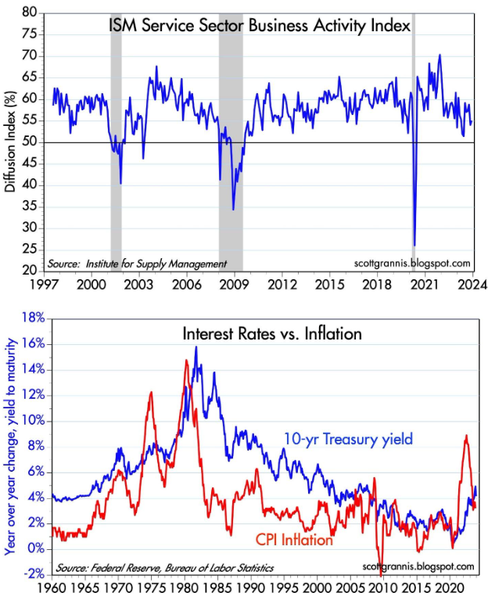

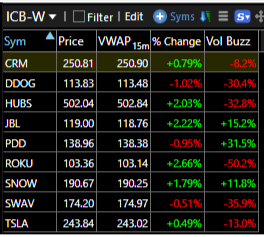

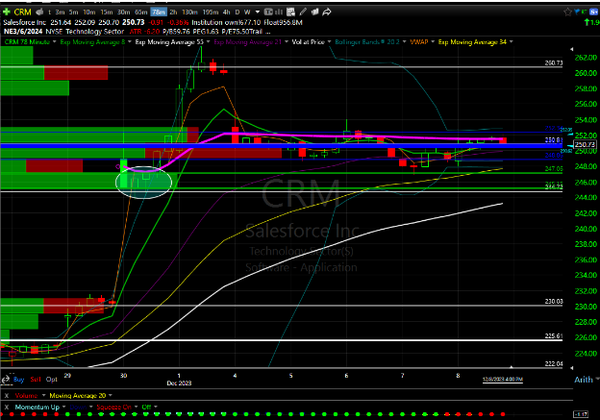

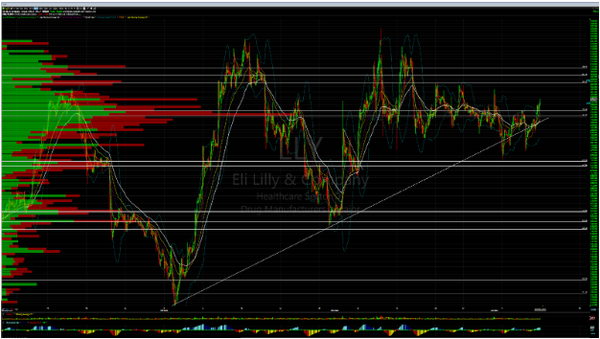

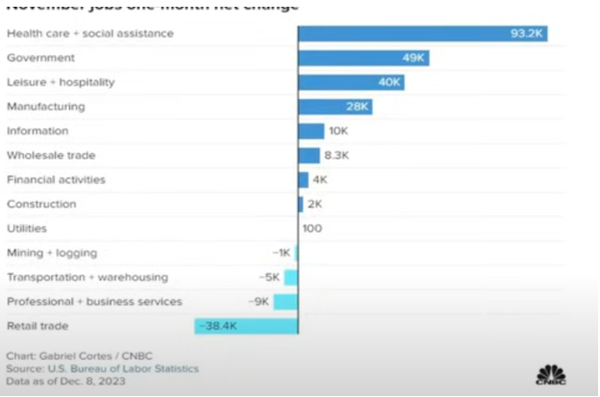

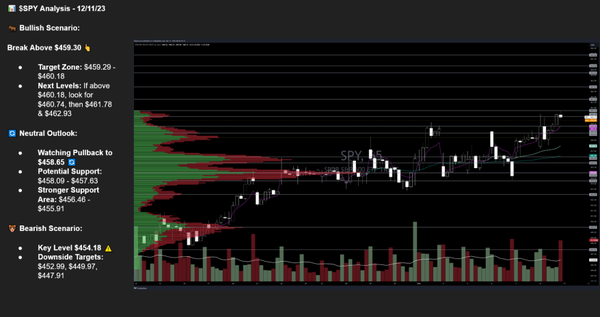

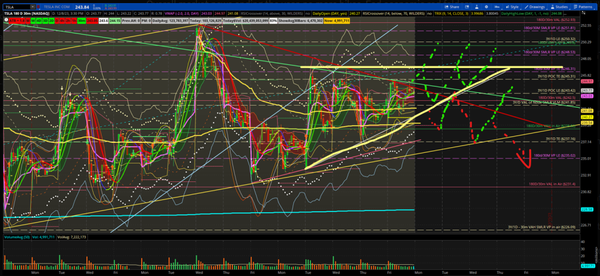

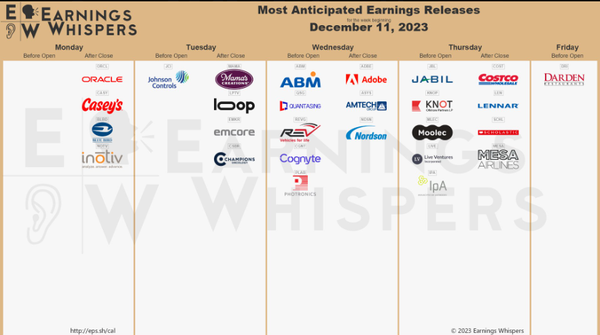

| Good Morning TTU Remember when I said the market would CHASE us into the end of the year? SHOW ME THE MONEY!!! This is what it looks like to be chased!! (Explaining this for the BETA males like Nate G who have never been CHASED! Bahaha) End of October looked like this  LESS THAN 30%! By middle of November it looked like this  Double to 62%! NOW we are above 80%! (SEE BELOW)  Remember, I work my #$$ off when nobody else wants something. The work is to protect me. If my timing is wrong, I am protected and will try again. When I #$!&$*g nail it… sit and watch the chase and play TA! Last year I said 2023 would the year to build generational wealth. CHECK Since August of this year I have been saying November would provide a rally. CHECK Now I am saying that the last couple weeks of December will provide a Christmas Rally! We already got long AMZN, AAPL, NVDA and some other great companies last week. Let’s just let em ride into year end and see if we can get that NAAIM up to 90-100% All signs a go for the FED   If we do enter a recession, watch for this gap to widen on the 5-year CDS spreads. Many people are calling for $hIt to hit the fan next year and we fall into a recession. I would argues against that and say I am more worried about 2025 than 2024. But as always, I’ll follow whatever the data is telling me.  Next week we have CPI on Tuesday, Jobless claims on Wednesday, and then the FOMC statement on Thursday. This will bring a lot of volatility but I don’t expect much to change. I think Powell will focus on “returning rates back to 2%” and “lowering the balance sheet” and stress “higher for longer” INSIDE WEEK! – https://www.tc2000.com/~9cYUS3  CRM  TTM look out! AMZN – We are already in – not afraid to add TSLA – stacked! AXP – Stacked! BAX – ISRG – ROKU – stacked and FBD MSFT & NFLX – 78 SHOP 195/130 LLY finally filled me on the long! You can see below that we crawled back into the trend and broke above VP. Also has a nice daily and 195 TTM squeeze  CRSP VKTX gene editing approval PARA – possible buyout – 2nd day play Over ALL PE ratios SP = 18.9 times forward earnings Midcaps are trading at 13.9X Small caps are at 13.2  SPY from JJ:  TSLA from TomTom: Continuing to expand my data absorption tracking China red folders. China had good inflation and PPI release on Friday evening. I would like to see TSLA close above 240 today in advance of tomorrow’s data. Any drops below that level and within the AscTri lower trendline will be good for entry to continue the AscTri pattern. If the pattern continues, we have a chance to break up to the top of the AscTri at 246.31 today or tomorrow. This will be the 3rd or more hit of this trendline so we have a chance to break through. With economic red folders tomorrow morning we may just chop today. I will look to continue to scalp and lower my cost basis for a potential good news release for tomorrow morning. Potential catalysts through the end of year: Deliver news for Nov and the quarter that points to YoY meet or beating expectations Overall market news ending the year, no more hikes, Fed economic red folders Sweden and Denmark delivery disruption (unionizing attempt of 130 employees) should only account for 2500-3000 cars this quarter. Combined they only received ~10,000 deliveries last year. Suppose we add Finland to the list the number tops ~11,500. Now if Norway gets involved, that is close to 21,000 a year bringing the total to 32,500 for a year but ~8,125 a quarter. -There is a secondary concern regarding aluminum parts from Hydro Extrusions supporting Berlin factory. If Metal union applies enough pressure to Hydro and they have employees strike, then we see a larger potential impact to Berlin production rates.   Economic News Schedule We have CPI tomorrow morning!  Earnings This Week  Have a great week!! |