Happy Monday TTU!

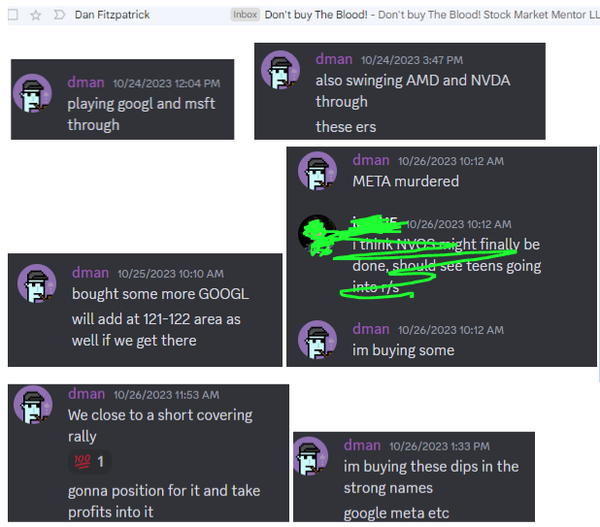

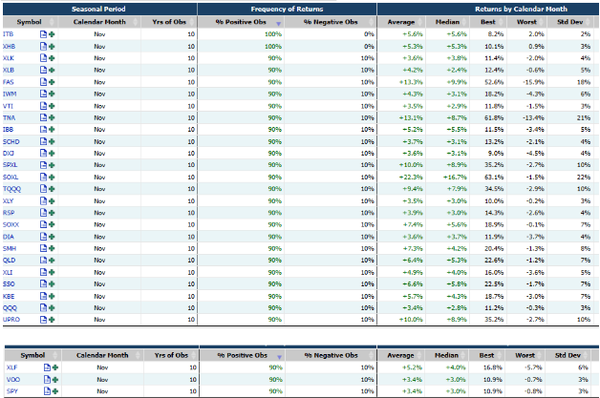

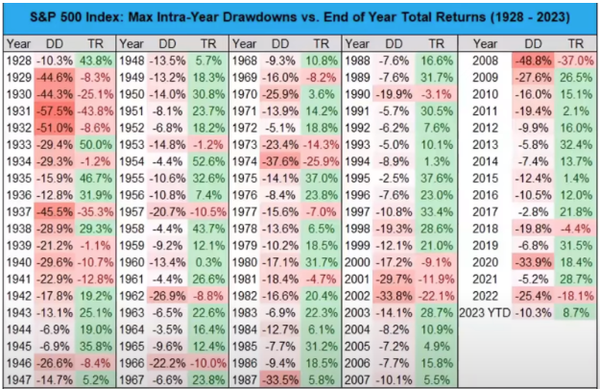

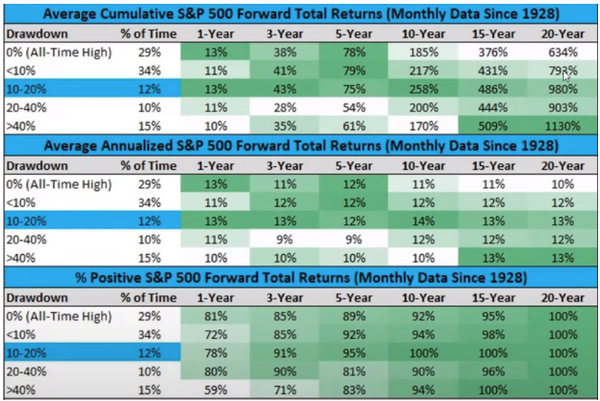

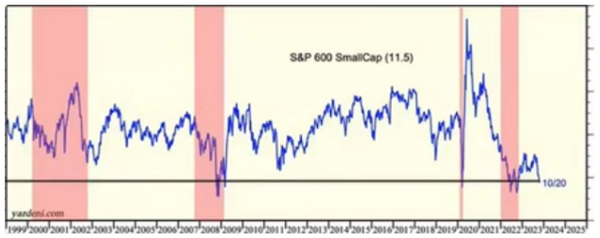

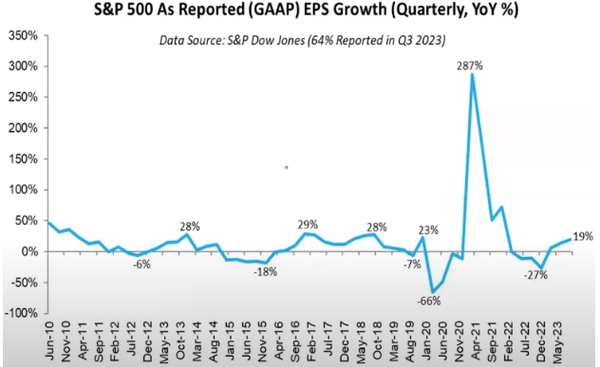

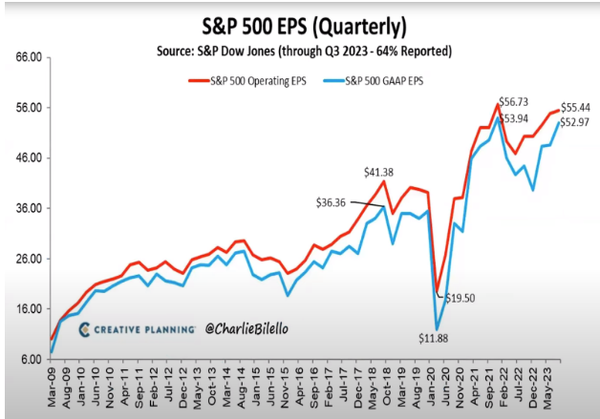

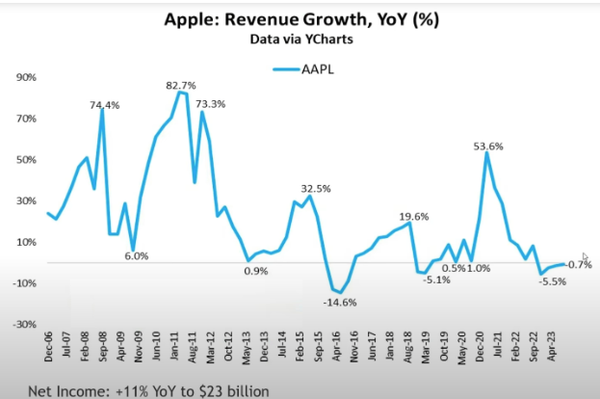

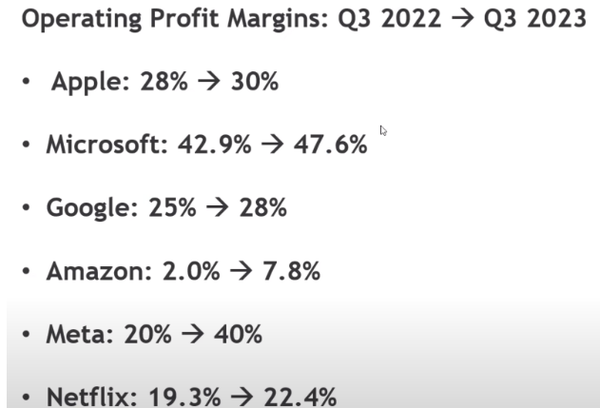

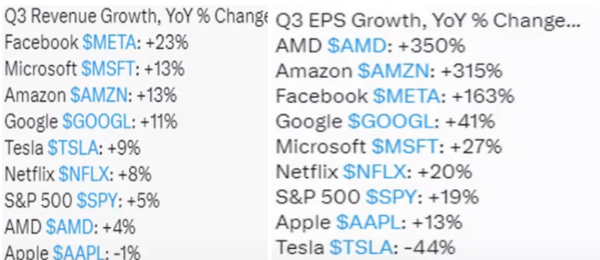

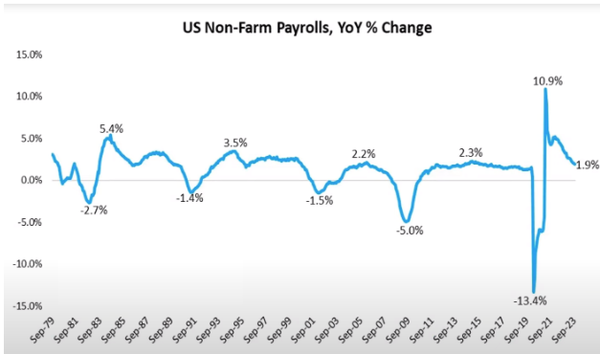

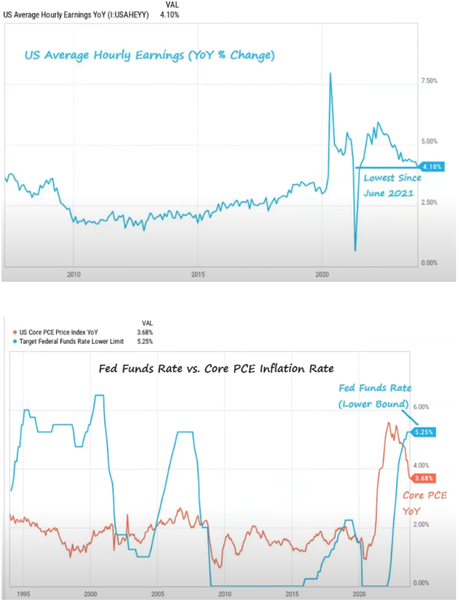

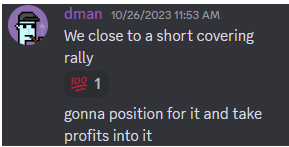

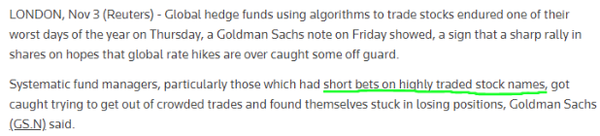

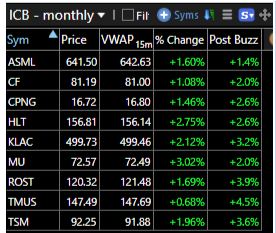

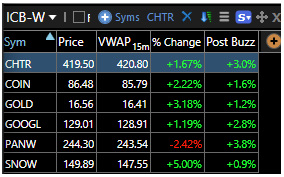

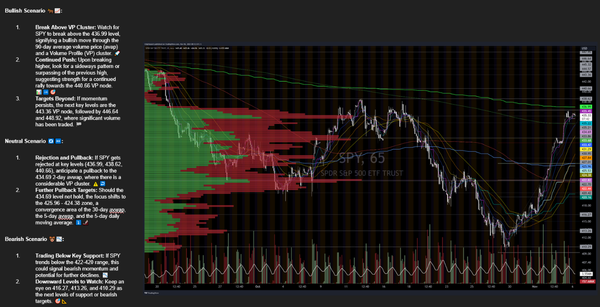

| Happy Monday TTU!! Remember tomorrow is our OPEN HOUSE!! If you are already a member no need to sign-up we will be hosting in the main room, so come join us. You can share this sign up page for anyone that is not a member and that will give them access for the day! https://foundation.thetradingu.com/one_day_free_access Last week was a horrible week for me. My mother took a hard fall and hit her head. I have her home with me now, but she isn’t getting better. At any point in time, I may need to leave a session because she is getting up and moving around. When it comes to the market, it was one of my best weeks ever. I want everyone to remember what they felt like 2 weeks ago and then compare it to what they felt last week. If you missed the rally and wanted to participate, you must use an edge that allows you to do so safely. This week, I am going to focus on teaching you how I caught the dip and did so safely. I did this all live 2 weeks ago when I was on the mic but I was also trading with my good friends as well. While everyone was saying “don’t buy the blood” I was busy doing exactly that! I was playing through earnings on many names and bought the dip when people overreacted.  Remember remember the cash we make in November!!! You can see the seasonality in November is off the charts!  I was waiting for this week since the end of JULY! I have been telling you guys this was coming!! What I didn’t know was where would the rally start from. It happened lower than I thought it would, but I was able to nail the bottom and now I have free trades set up if we break lows. If we look back at the past 3 months, what has happened? A few bad months and 1 good week! Does this change anything? I believe it does. I have been saying the FED is DONE raising rates for a long time. Now everyone agrees with me. This is a fundamental change. Remember last week I told you the problem people were having was pricing out the value of companies cause of the rates. Now we have a clearer picture… for now. This means people are willing to buy. Historical drawdowns have an average of 16% per year. We hit 10% so far this year. In my opinion the bottom has been put in. I am looking to add on pull backs to VP levels or breakouts of VP levels.  I also picked up some long-term picks like GNRC. I am always looking for value plays. Once I find good companies that are undervalued, I will add them to my watch list to play technical analysis as well. Understand that I am an investor first and a technical analysis second. See the chart below and you can understand why I am an investor. It is the easiest way to trade. It has the highest win rate and when you combine drawdowns with companies that are temporarily impaired, you have a powerful combination.  The next drawdown we have in the market, I want you to look at this chart. That way you will see the drawdown as an opportunity instead of something negative. I also picked up XBI and IWM last week at the lows because I believe they will start getting bids now that people agree with me on the rate hikes being down. You can see from the chart below that we are a historically low valuation on small caps. These are longer term holds, but I will do my normal taking profits on the way up and adding back as we get over resistance levels.  My fundamental belief is that earnings are what drives the markets. I kept saying earnings were going to be better than expected and this will continue throughout the year. You can see from the chart below that I was correct in that assumption. We are having our 3rd straight quarter of growth and we are going to report a positive number!  After this past week the S&P 500 is now reporting year-over-year growth in earnings for the first time since Q3 2022. Overall, 81% of the companies in the S&P 500 have reported actual results for Q3 2023 to date. Of these companies, 82% have reported actual EPS above estimates, which is above the 5-year average of 77% and above the 10-year average of 74%. You can see from the chart below we are almost back to the peak of 2022 when it comes to earnings.  One thing that stood out to me was when AAPL reported “ok” earnings, the market still rallied. AAPL is reporting another quarter of negative returns but their net income is 11% year over year because of the cost cutting.  Many of the tech companies did this and this is one of the reasons I have been investing heavily in tech. Once the revenue returns to pre pandemic levels, the cost cutting benefits will still be there.  Check out META in the chart above. Remember how much cash they were burning last year? What a turnaround! You can see that the big companies are all starting to bear their YoY except for AAPL, but look at the net income from each of these companies. AMD is leading the pack!  Do you understand why I keep trading these names? How many times have you heard me say anything about AAPL or TSLA when it comes to buying and holding long term? These are simply chart plays for me. In and out! One thing that catapulted the market even after AAPL had lackluster ER was the jobs data. Pay attention to the trend. This is what Powell wants.  One of the most important things to keep an eye on is the hourly earnings YoY. This was one of Powells most important indicators to gauge inflation. If peoples pay continues to rise then so will inflation.  Remember I said we were close to a short covering rally?  It is always fun taking the big boys money!  For the upcoming week I am expecting sideways action, but I am not opposed to continuing the chase. The inside month and week are below.   AMD is an inside quarter with a failed breakdown – this means I am looking for an engulf candle on the quarterly Our weekly squeeze in MU is looking great – I take profits at double top areas but am holding this one until we reach the 127.2 and maybe further. We have an inside Q that is breaking up with an inside month that broke up Our long term play in TMUS is reaching 150 target and I will take some profit into this area. We are breaking up now on the inside Q and the inside month. We started C back in September and I have taken profits one time and added lower 2X – I am going to be selling some of these add backs this week. Again, just lowering cost basis, if we break higher I will pay up for more shares. A lot of the names I held through on earnings have paid extremely well and I will taking more profits in them this week. Things like META, NFLX, GNRC etc. The adds I made for shorter term swings in MSFT NFLX and AMZN I am also selling this week.  SQ – 1 bill buyback BUD – 1 bill buyback SHEL – 2.5 Bill buyback TS 1.2 Bill buy back HSBC 3 BILL BUY BACK Snap 500 MILL BUY BACK RTX – 10 bill buyback TMUS 19 bill share buyback SPY Analysis from JJ  |