Happy Monday TTU!

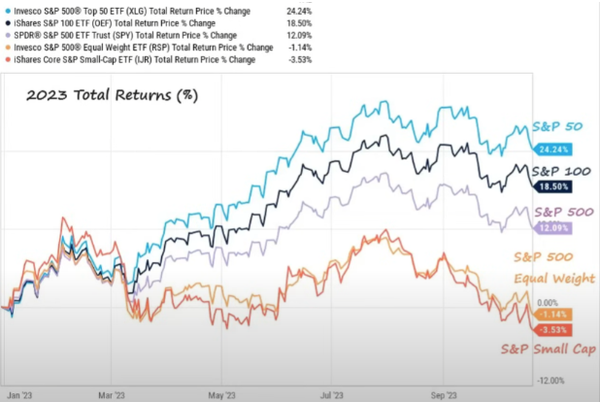

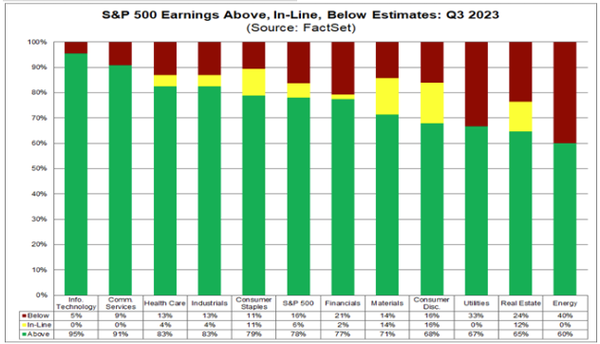

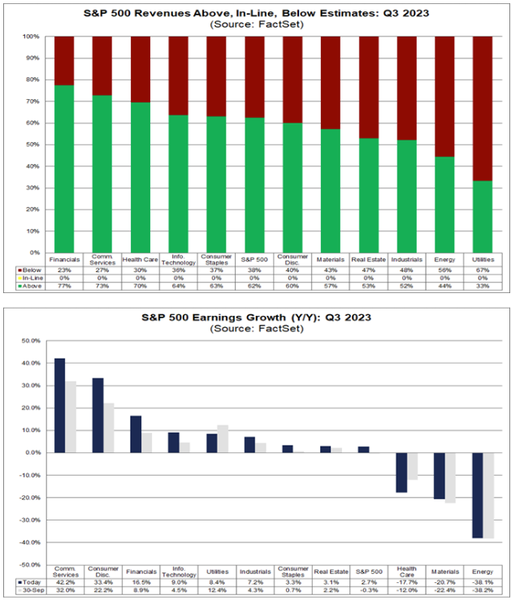

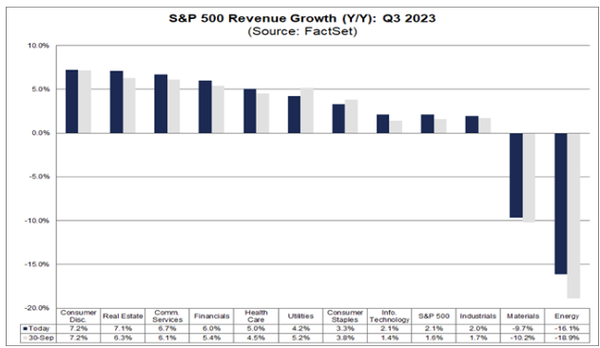

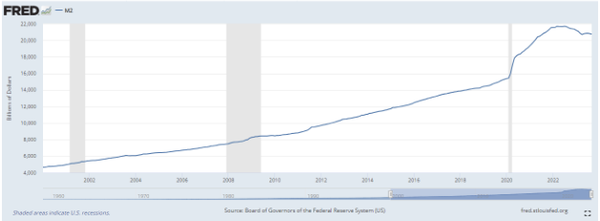

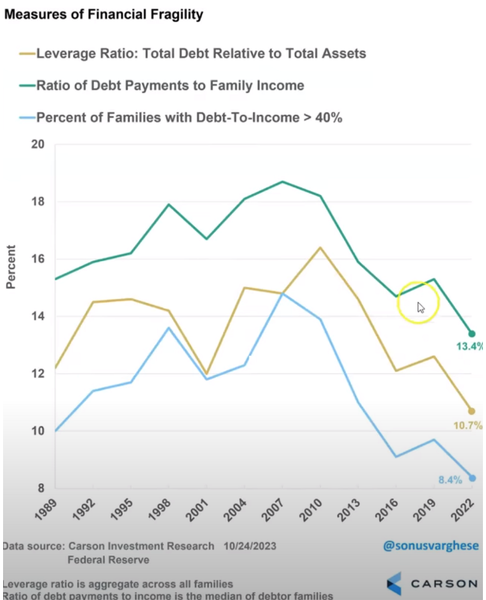

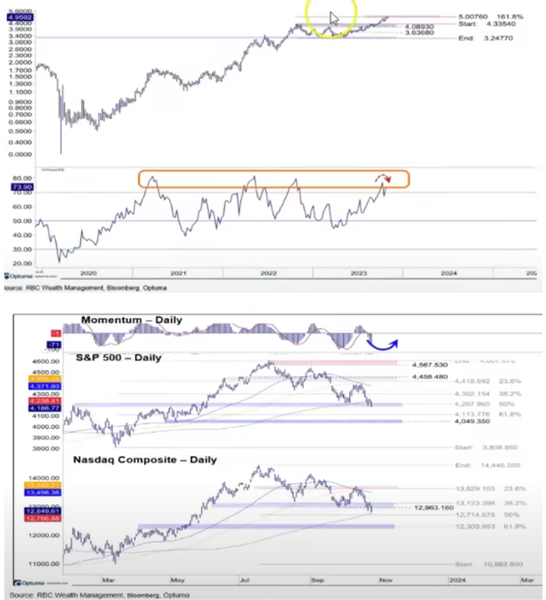

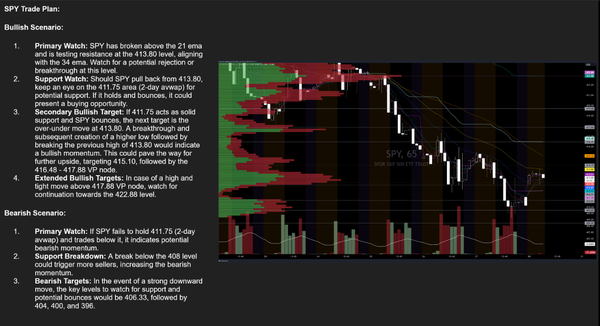

After AMZN earnings I wanted to take a fresh look at the entire market. I have been saying for a while that we will have to “look under the surface” to find the deals in the market. I don’t think the big companies will do badly, but I do think there are better deals out there. Maybe I am/was too focused on the big names. This was Thursday’s heat map. Below is Friday’s heat map.  You can see it almost inverse. I honestly believe to get a sustained bull market we need other things to carry the market besides the magnificent 8. I put the graph below in the newsletter last week.  I believe we need the small caps and other companies to start getting a bid. This will help close the gap on returns and hopefully buoy up the market. I don’t think it is healthy to have a handful of companies keeping up the entire market. I don’t know if these other companies can get bids before the FED signals a possible cut on the horizon. I am guessing that the fear is because of the unknown of war, a possible recession, the unknown of rates, and the present value of money. I believe buying bonds right now is a safe investment. I don’t see rates going much higher and I think they will get cut within a years’ time. If I was losing money in the market, I would consider a safer investment. The opportunity we are having now to get paid for having cash hasn’t come around for a long time. I am buying T- bills and bonds for the first time in my life! However, this is a small portion of what I have invested. I still believe the greatest wealth generator is the US markets. At the end of each week I go back and look at my long term goals and investment decisions to see if they need to be adjusted. Here is what I am seeing on the earnings front. We are at the midpoint of Q3 earnings and the S&P 500 is reporting a year-over-year growth in earnings for the first time since Q3 2022. A couple weeks ago I posted a chart showing the target was -.03 and IF I am to remain a bull we have to start seeing growth AND projections for continued growth into the future. With half the companies reported it is estimated that earning growth will be about 2.7%, which is well above the -.03% estimate. So this means all is well and that they are just shaking out the weak hands and we are going to RIP into the end of year right???? NOT SO FAST MY FRIEND!!  Many analysts are lowering their earnings growth forecast for the future. For Q42023 it goes from 8.1% down to 5.3%. For 2024 analysts are calling for YOY earnings growth of 11.9% vs 12.2%. With reduced projections by analysts, does it really change that much? Right now, we have a 12-month P/E ratio of 17.1. This is below the 5-year and 10-year averages.    Everyone is reducing expectations because of the concern of a recession. The old school says it takes 12-24 months for the recession to hit once the yield curve inverts. I believe we are 12-13 months in! This means that within the next 12 months, we should enter a recession. This coincides with the FEDs tightening policies that will have the lag effect. This also coincides with student loans coming back and people needing to make those payments. It will also be harder for people to buy big ticket items on borrowed money because of the high interest rates. The case for a recession, or at least a big pull back in spending looks like an open and shut case. The question that remains is – Why is the economy still growing… and growing quickly?  https://finance.yahoo.com/news/us-economy-grew-4-9-133344767.html How many times in the history of our country, or in the history of fiat currency, have we created this much excess cash? We still have trillions of excess cash in the system, and it will take a long time to work its way out of the system. The problem we are seeing is the panic of “not knowing”. Because we can’t forecast the value of companies for years to come, people are simply hitting the sell button. If you don’t know what interest rates are going to be in the next couple of years, it is impossible to put a value on a company. Our interest rates change weekly! This causes all kinds of panic. We need the uptrend in interest rates to reverse if we are to get a low and rebound in equities. My personal belief is we are reaching a top in interest rates and that we will begin to move lower relatively soon. If we don’t and panic continues, I believe the FED could use yield curve control. If we are to see a trend change here, we need these to start rolling over and break these support levels below. Think of it as TA – we need to break below 4.5% on 10Y and 105.3 on DXY The actionable item for me is simply find good companies that are undervalued for the long term and begin building a position or keep adding to your position. Here are a list of companies that I like and I believe have solid businesses and have a chance of getting outsized returns over the next 12-24 months. We have the known companies like GOOGL, AMZN, META, INTC etc. I am going to focus on companies that are not in my normal trading bag. AAP, MMM, BABA, DIS, NKE, BAC, C, Maybe CPS, PYPL, SWK, VNO, XBI, HSY Here’s what the bears are screaming from the rooftop.  The contraction of the money supply is causing a real danger. They are saying the stimulus money is running out and as soon as it does, look out below! The problem with this is that they aren’t looking at the amount of excess money we still have. The economy has been strong, and we have been growing and not shrinking. (debatable if you think the government is simply growing vs private sector) Below is the M2 money supply and its obvious we are trillions of dollars above the trendline. Like I said earlier, how many times has this experiment been done in the history of fiat currency? NEVER! So how many years of contraction will it take just to get it back to “normal”.  But credit card debt is SOOOOO HIGH and families are in trouble now more than ever! Oh really? Lets look!  So here is what I expect going into November – I believe most companies and execs will be looking to get buybacks going and snatch up their companies at these great ratios. For example, Paypal could buy back their entire company within 5-6 years with the amount of income they generate.   SPY Analysis from JJ  |

4 Comments

JayTrader

Donald, your feel of the market is like no other! Thanks for this!

James

So much info! Thanks for posting.

Jeremey472

Donald, Ryan and Faculty – Amazing insights on the market. This analysis is far greater than any other service I have been apart of. TTU is amazing! You guys take time to make sure each of our questions are answered and provide feedback on our trades. My trading has neve been better since joining! Thanks again.

Thomas Johnson

Thanks for thr great article!