Happy Monday TTU!

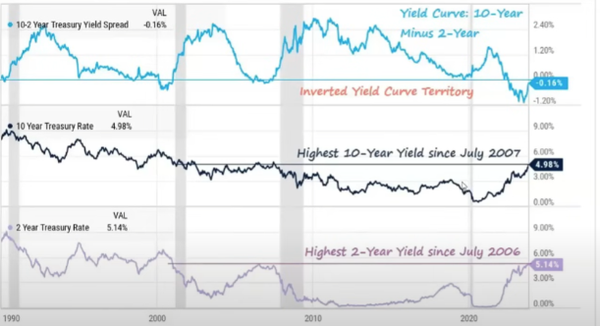

What usually happens before we enter a recession? Usually the 2 year usually drops at a much faster rate than the 10 year in anticipation of rate cuts. According to Papa Powell we aren’t anywhere near cutting rates! However, many people are anticipating cuts much sooner than we are being told. What the FED is trying to do is the goldilocks scenario of causing tightening within the economy WITHOUT causing a recession.

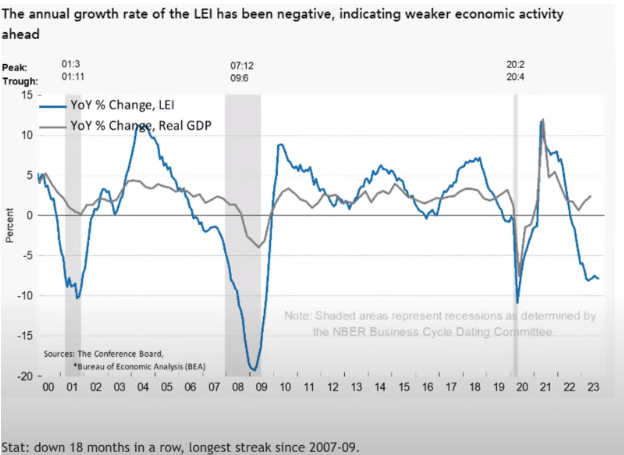

The conference board (people who put out this index) have been predicting a recession every quarter since the end of 2022. Literally… they said it would start at the end of 2022. That didn’t happen, so they changed it to the first quarter of 2023, then the second quarter of 2023, then the third quarter of 2023 and so on.

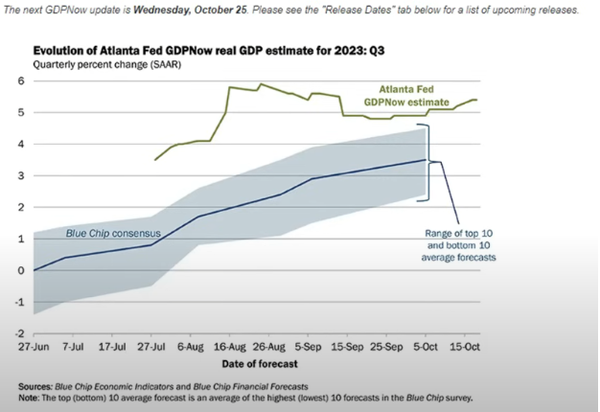

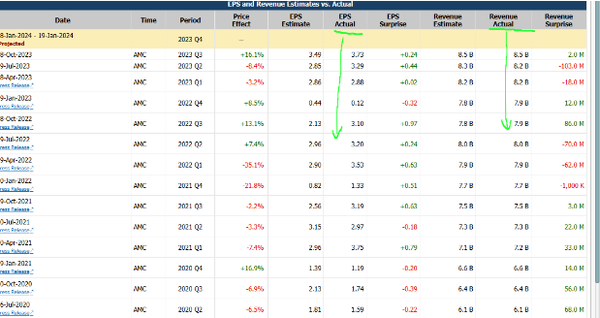

You can see that the growth rate is still high and the blue chips are still growing. This is why I continually say that EARNINGS RUN THE MARKETS and if companies are reporting growth, or above the expectation of shrinking, then I am a bull and will remain long and strong! If this blue line starts to curve down and things begin looking bleak on the earnings front, I will change my opinion AND investment strategy.

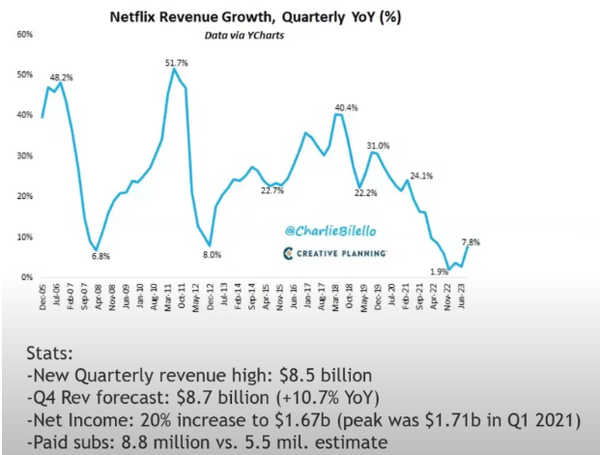

An example of a company showing GROWTH and above expected returns was NFLX report last week.

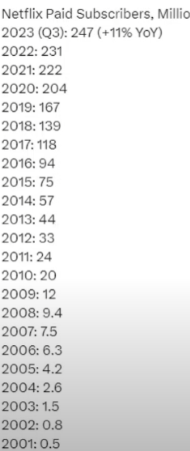

Almost 8% year-over-year and projecting almost 11% year-over-year for Q4! You can see below that REV continues to increase as well as profits!

One of the best points of the ER for NFLX was they added 8.8 Million paid subs vs the 5.5 expected. The question becomes, what’s the top?

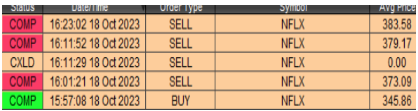

The one thing everyone needs to learn from NFLX is that expectations are what drive reactions. NFLX CFO came out and said some thing that made a lot of people sell. This in turn brought expectations EXTREMELY low. Being able to spot over reactions VS real problems is the key to finding value in the market. When META started burning 12Billion dollars a quarter, that’s a real problem! Once they stopped, the story changes.

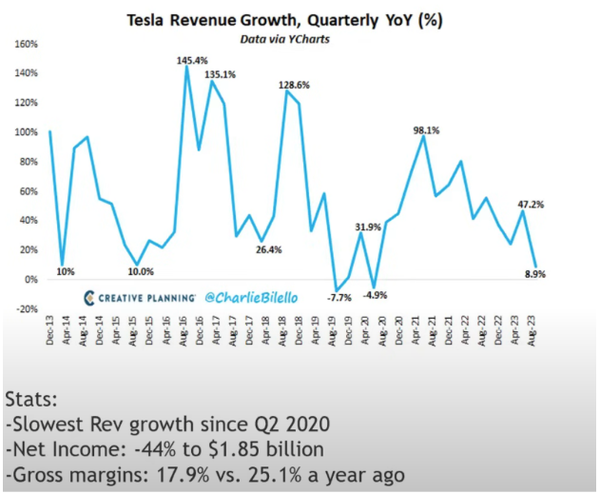

Now the flipside to this company’s good earnings report was TSLA.

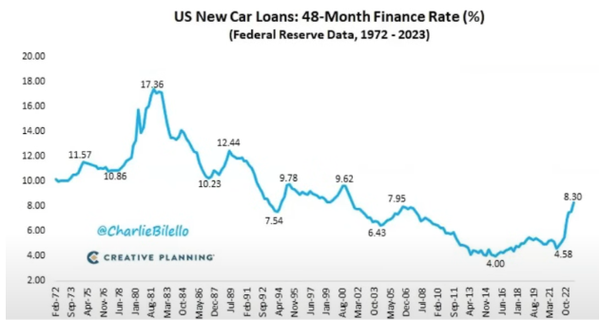

Revenue growth slowed even with the price reductions which slashed margins and profits. Imagine if you made -44% in a quarter! How would that effect you? Elon emphasized the interest rates and said that was the major headwind with 80%+ of people financing cars and the finance rate is now 8%.

What you must ask yourself is – “Is Elon Musk correct in thinking of cutting profits now for taking market share and profits in the future”. If you believe this will lead to profits in the future, then we can look at this as a buying opportunity. I am a believer in Elon and will try and bounce this drop.

I believe the earnings reports coming out this week will tell us if my conviction on being a bull is worth keeping or not.

For this week we have a lot of earnings I will be playing. I suggest just watching and learning the why of everything. The great thing about earnings is they happen 4X a year!

Other plays include ICBs like COIN

COIN has been coiling and could get a big move in either direction. I am willing to play both sides.

HSY is an ICB as well that I am watching. They got hit on some news and have been almost straight down. IF we can break up and start cracking above major VP levels above, I might take this as a swing play.

AMZN is an ICBW as well. It closed extremely weak and if I do play this to the downside it will only be as a daytrade.

ADBE is another ICBW. I would LOVE for it to break down so I can get filled around 520 for a long. Same idea for this one as AMZN – if it breaks down its only a day trade.

AVGO – another ICBW that looks extremely weak.

MCD is an ICBD forming a descending triangle type pattern. Willing to play either way.

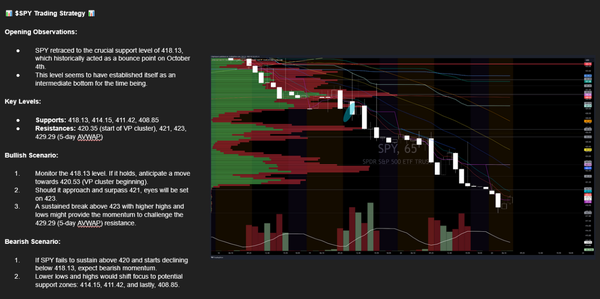

$SPY Analysis from JJ

3 Comments

dd

dd

Ryan

Great analysis for the week!

Nick

Thank you for this! I have been reading “The Quad” posts and decided to become a member! I am so glad I did! Thanks Donald, Ryan and the rest of TTU!