Good Morning TTU!

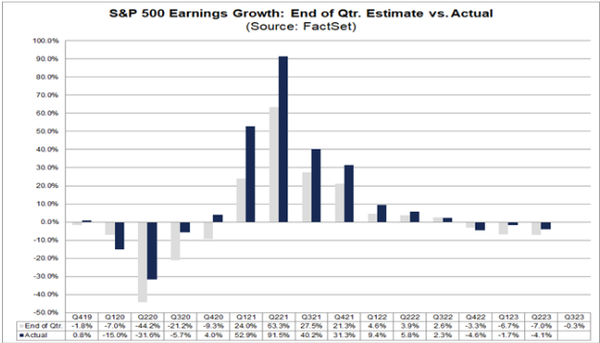

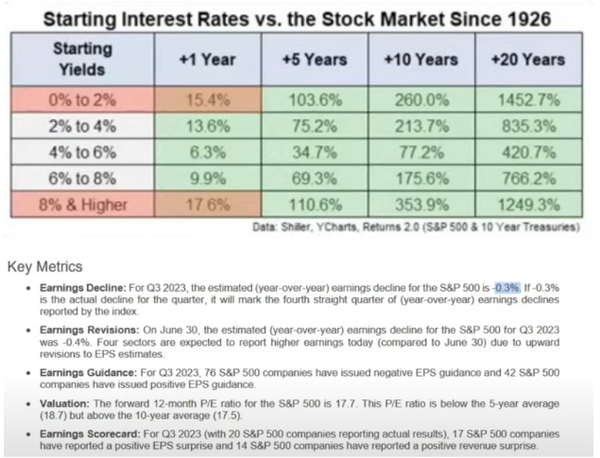

Happy OPEX week! Last week I talked about companies with cash having good earnings reports and that I expect the SP500 to report year over year earnings growth. If they do, it will mark the first time since Q3 2022.

I have been a bull for about a year now and will continue to be a bull if earnings keep coming in better than expected. IF earnings start coming in weaker than expected, I will cash out of my long term holdings that I have been holding since October of last year and look to reset. Before this last push in the market I was about 70% net long. Now I am about 50%. I will be looking to put 25% or so back to work BEFORE major earnings announcements.

Here is a link to my spreadsheet for earnings.

Donnie workbook WL September 2020 1drive.xlsx

Here is a link to the video on understanding how to read and use the spreadsheet.

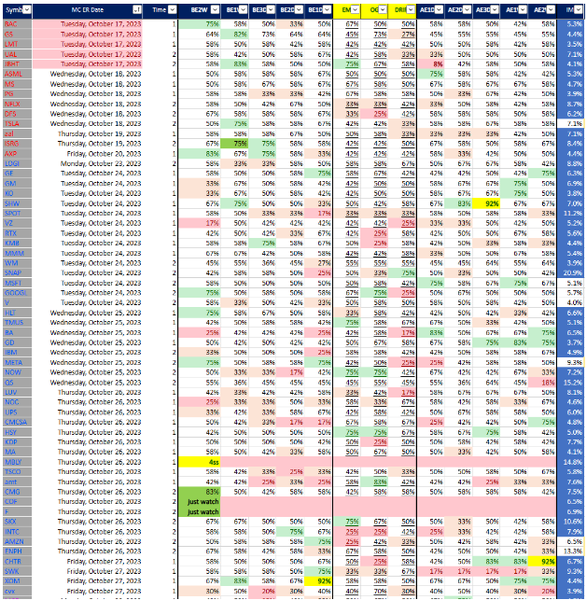

Here is a pic of the spread sheet with the stocks I am watching for the next couple of weeks.

META and GOOGL run into earnings from a couple weeks out. META usually has a good day -1 from ER and google has a great OG with a great drift as well.

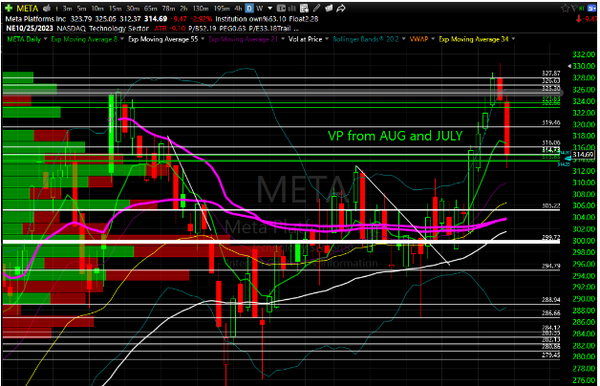

META – I am looking to get into META for a run into earnings, I am willing to take shots at the 313-315 area. If this breaks down, I will stop out and look to pick some up between 300 and 305. On all these entries my risk is the lowest number of the range. I am also a long-term holder of META and willing to STO options at the ranges of expected move on dips and rips. (DO NOT SELL TO OPEN OPTIONS IF YOU DON’T KNOW WHAT THIS MEANS)

Here is my chart of META with VP lines – https://www.tc2000.com/~2RBnVC

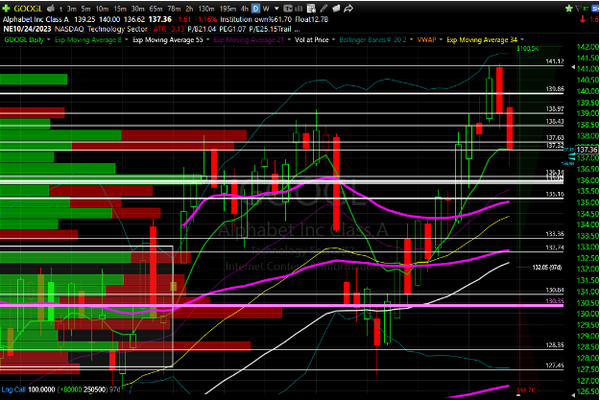

GOOGL – I am also looking to add back what I sold on Tuesday and Wednesday of last week. I am a buyer for sure around 135-136 area. IF we don’t get down there and we create a reversing pattern off 137, I am willing to pay up. Remember, I think earnings will be good, so I am going to hold some GOOGL shares through earnings. THIS IS HIGHLY RISKY as we could gap up 5-6% or gap down 5-6% (this is the implied move). Remember, I am still holding a lot of GOOGL from 130 and lower, so even if we do gap down, I will be fine on my cost basis. What the stats say usually happens on GOOGL is we gap up on the day of earnings and then sell off all day. I am looking to capture some premium on the gap up as well as sell some shares into that gap.

TSLA – The run up into TSLA usually starts 1 week before earnings. Because we have sold off the past couple of days, I think TSLA is giving us an opportunity to make some money before and possibly through earnings. I believe the UAW strike is a good thing for companies like TSLA and I think the way Elon has handled the demand problems, by cutting prices, will help the revenue number. What may cause a problem is the margins.

A couple of ways to approach the chart on TSLA is to risk last week’s low area of 250. The main VP level I see is 245-246, which is also the trendline. IF 250 breaks down I will be a buyer at 245-246 area. IF we start putting in a reversal pattern around 252-255, I am willing to play that pattern as well using last week’s lows as risk.

Stocks with historical run ups starting two weeks out are PAYC, BLDR, ELF

NEWS PLAY ON LULU – LULU is set to join the SP500 and popped after hours 5% – I am willing to play this both ways.

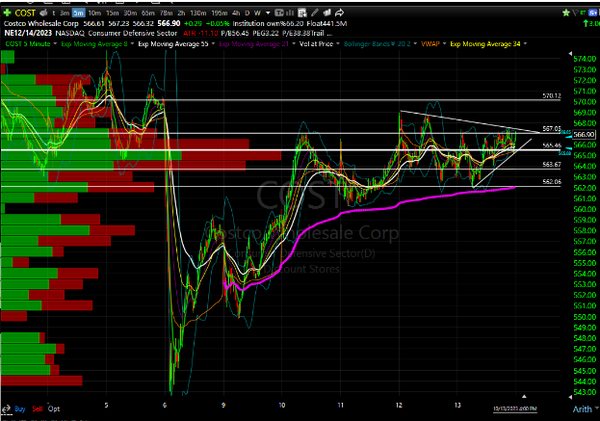

This COST chart is screaming at me to get in for a break higher. We played the bounce from 10-6 and I am still wanting to add more. COST is one of my favorite companies as well so I might be being a bit bias. It has stakced squeezes as well as an ICBW. This means I can play the breakout or the pullback. I need this to stay above the recent consolidation for me to remain in the play – ideally we stay above 563.50 area but the last ditch effort to save it will be 562. Risk accordingly.

LONGTERM plays – I sold some C (Citi) from the recent long-term purchase for a gain of about 10%. I will be adding this back and then STO calls against those shares.

I did the same for DIS as well and am looking to add these back as well. We had news of Nelson Peltz increasing his stake and looking for a board seat.

You can read about the problems DIS has faced as well as what Peltz thinks his company can do to help DIS here,

https://www.sec.gov/Archives/edgar/data/1345471/000090266423000183/p23-0016_exhibit1.pdf

DIS has had a lot of self-inflicted wounds, but I still believe they can turn it around and we could get a double in 1-3 years. However, IF DIS does not change their management style, I will quickly sell.

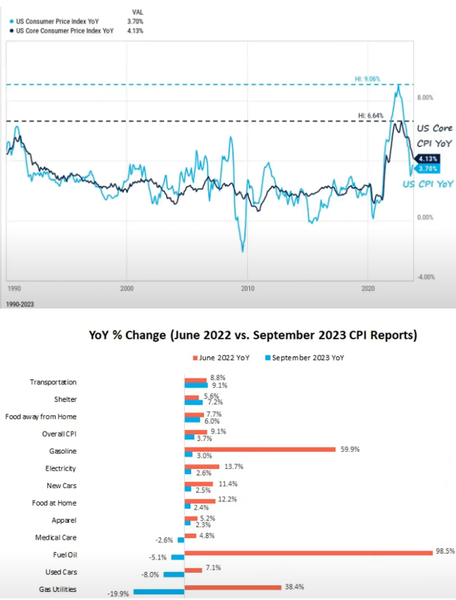

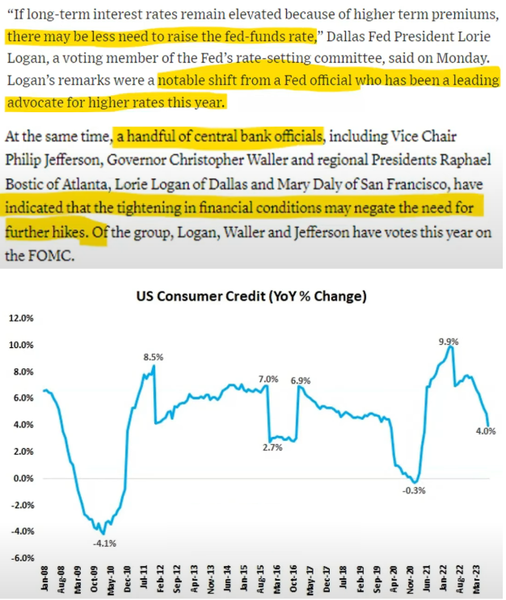

Demand is being crushed which is what papa powell wants

Economic News Schedule

Earnings This Week

5 Comments

Marc M

Thank you TTU! this provides us with numerous trading opportunities supported by a wealth of data and statistics. Having access to well-structured charts featuring valuable volume profile levels, generously shared by experienced traders, is truly fantastic!

Greg (TraderG)

These are so valuable to have to help setup the week!

CC

I love earning season with Donald! So many setups and data/statistics to backup trade ideas what more could you want. Charts with great VP levels to watch and create trade plans off of handed to us by a master trader! Heck yeah! So much detail and opportunities for day, swing and long term trades. Getting this daily plan every morning is priceless!

Binance

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

binance

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?